How to Prepare for NIACL AO Accounts Exam: Ultimate Guide

From AI integration to cross-platform fluency—discover the must-have technical and soft skills for today’s most in-demand dev roles.

by Admin

The NIACL AO Accounts exam is a highly competitive exam that tests your expertise in accounts and finance. To succeed, you need a well-structured plan that covers all the critical topics and ensures you’re ready for the professional knowledge section. This guide will provide you with an actionable strategy to prepare effectively and boost your chances of clearing the exam

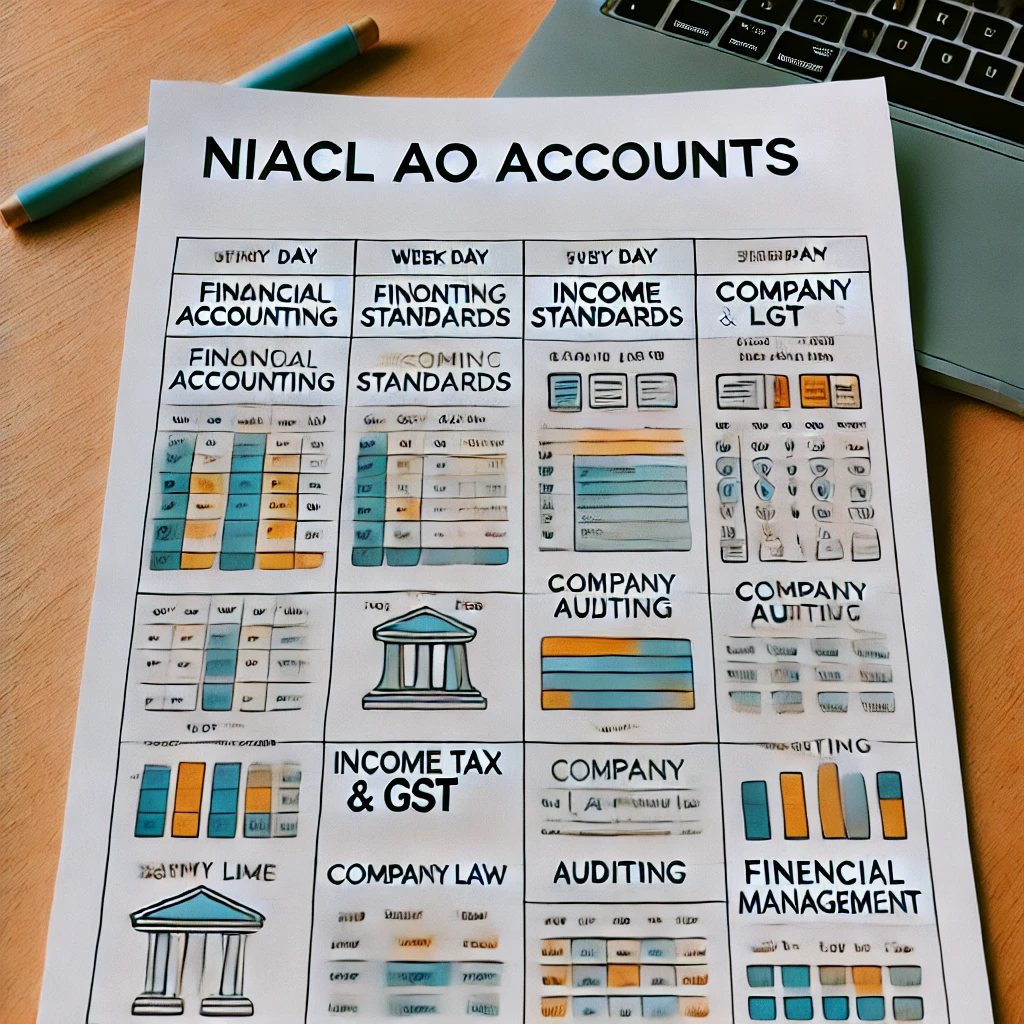

Step-by-Step Study Plan

1. Understand the Syllabus and Exam Pattern

Before diving into preparation, it’s essential to be familiar with the syllabus and exam pattern. The prelims exam focuses on reasoning, quantitative aptitude, and English language, while the mains exam for the Accounts stream emphasizes professional knowledge.

The Accounts section includes:

- Financial Accounting

- Accounting Standards (AS) & Indian Accounting Standards (Ind AS)

- Taxation (Income Tax and GST)

- Company Law and Auditing

- Financial Management and Analysis

- Digital Ecosystem for Payments and Collections

Understanding the syllabus will help you allocate time and resources more efficiently.

2. Strengthen Your Basics

A solid foundation in Financial Accounting is crucial for tackling advanced topics. Start by mastering the core principles of accounting, such as:

- Journal entries and ledger postings.

- Preparation of trial balance and financial statements.

- Rectification of errors and adjustments.

Our NIACL AO Accounts course provides detailed lessons on Financial Accounting, helping you develop a strong understanding of these fundamental topics.

3. Dive Into Accounting Standards & Ind AS

Accounting Standards (AS) and Indian Accounting Standards (Ind AS) are essential topics for this exam. Many questions in the professional knowledge section revolve around these standards.

How to Study:

- Focus on the key objectives and provisions of important standards such as AS 1, AS 2, AS 9, and Ind AS 16.

- Understand how these standards are applied in practical scenarios.

- Practice challenging questions to ensure a deep understanding.

Our course covers all Accounting Standards and Ind AS with in-depth explanations and difficult practice questions to reinforce your learning.

4. Master Taxation (Income Tax & GST)

Taxation is another important topic that can help you score well in the exam. Focus on both Income Tax and GST provisions, as these are commonly tested.

Key areas include:

- Computation of taxable income under different heads.

- GST provisions such as input tax credit, reverse charge, and supply rules.

Our course offers a comprehensive study of Income Tax and GST, along with tough practice questions that simulate the complexity of the actual exam.

5. Regular Practice with High-Difficulty Questions

One of the most effective ways to prepare for the NIACL AO Accounts exam is to practice regularly with high-difficulty questions. The actual exam often features tricky, application-based questions that test not only your knowledge but also your problem-solving skills.

Here’s how you can enhance your preparation:

- Solve questions that require critical thinking and deep understanding.

- Focus on both conceptual and practical questions.

- Time yourself while solving to improve speed and accuracy.

Our practice sets are designed to mimic the level of difficulty in the NIACL AO Accounts exam, ensuring that you are well-prepared for the real challenge.

6. Company Law and Auditing Basics

Although not as vast as other subjects, Company Law and Auditing are important topics that should not be neglected. You can expect questions from key provisions under the Companies Act and the role of auditors.

Key focus areas:

- The duties and responsibilities of auditors.

- Compliance and corporate governance under the Companies Act.

Our course provides detailed coverage of Company Law and Auditing, along with practice questions that help you grasp these concepts.

The Role of Practice Sets

Since the NIACL AO Accounts exam is known for its high level of difficulty, practice is key. Our course offers high-difficulty practice sets specifically for the Accounts section. These sets:

- Cover a wide range of topics from the syllabus.

- Include tricky, application-based questions that test your conceptual understanding.

- Provide detailed explanations for each answer, helping you learn from your mistakes.

Regular practice with these sets will boost your confidence and improve your performance on the exam day.

Conclusion

Preparing for the NIACL AO Accounts exam requires a deep understanding of the subject matter, regular practice with high-difficulty questions, and the ability to solve tricky problems under time pressure. By following this guide and using our specially designed practice sets, you can maximize your chances of success.

Our NIACL AO Accounts course offers comprehensive study materials, challenging practice sets, and expert guidance to ensure that you are fully prepared for the exam.

Looking for a way to ace the NIACL AO Accounts exam? Get access to our complete preparation course, including detailed modules and high-difficulty practice sets designed to give you the edge you need.